When Colorado becomes a Free State, every worker will be able to keep their whole paycheck.

Coloradoans work hard for their money and they deserve to keep it.

If there is one thing you are entitled to in this country, it is your hard-earned money!

A worthy goal of Liberty Activists is to ensure that Colorado’s paychecks are kept intact.

Adopted by Colorado voters in 1992, TABOR has been one of primary systems that has kept Colorado taxes low.

Recently, TABOR has been under assault from Colorado’s Political Authoritarian Class.

Liberty Activists must always be on the lookout for opportunities to defend and strengthen TABOR.

Taxation reduction has become an issue that has broad support and might be one of the best opportunities to make Colorado a Free State.

This is the second in a series of posts centered around specific goals for the Liberty Movement of Colorado.

Please share, and leave a comment with your thoughts!

Taxation is Theft

Not only is taxation theft, but our stolen income funds the government’s authoritarian policies.

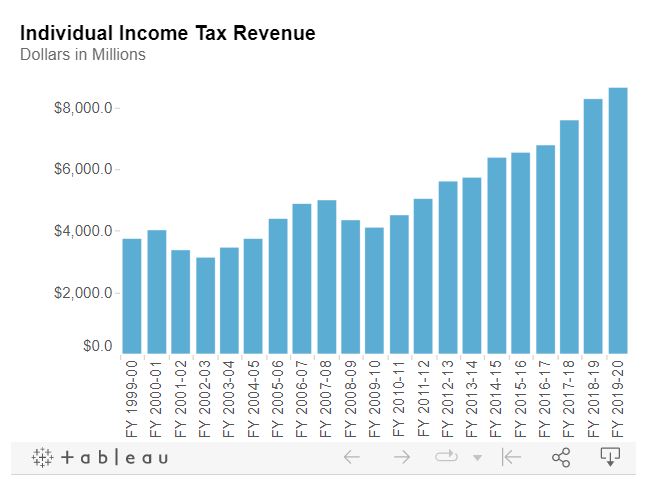

In fact, the state income tax constitutes the majority of Colorado’s tax revenue.

Personal income tax constitutes 51.5% of the total tax revenue that the State collects every year. (source)

The State’s fleecing of the people has only been legal since 1937.

For the first 61 years of Statehood, Colorado workers kept their paycheck.

In Fiscal Year 2019 to 2020, the State of Colorado stole $8.64 billion from taxpayers.

If the State lost this revenue, they would be forced to cut their operating budget tremendously.

This would force the State Government to scale back their central planning schemes.

And the injection of nearly $9 billion into the economy would create a new level of prosperity unseen in Colorado.

Colorado is unfortunately, one of only twelve states that tax Social Security Benefits.

Even if a full repeal of the State Income Tax cannot be accomplished in the short term, efforts to lower the tax can succeed.

Limiting Taxation: More Popular Than Ever

In 2020, voters approved a reduction in the State Income Tax with Proposition 116.

116 reduced the State Income Tax Rate from 4.63% to 4.55%

Since the initiative passed, the State has lost over $350 million in tax revenue!

Jon Caldara of the Independence Institute and State Senator Jerry Sonnenberg were behind the effort in 2020.

Now, in 2022, Caldara and Sonnenberg are back with another initiative to lower the income tax even further.

The 2022 Initiative, if approved by voters, will lower the State Income Tax Rate to 4.4%.

Although this is a small reduction, it will still help Coloradoans keep more of their paychecks.

In the summer of 2021, Governor Jared Polis, speaking at the Steamboat Institute, voiced his support for eliminating the State Income Tax:

From Complete Colorado:

“[The state income tax] should be zero.” In his words, taxing income “discourage[s] productivity and growth.”

Jared Polis’ statement garnered support from the Colorado Union of Taxpayers (CUT), and the Denver Gazette.

And FOX31 reported that the average Colorado taxpayer would save $3,300 per year!

During the 2022 June Primary Campaign Season, multiple candidates, including Heidi Ganahl, and Ryan Gonzalez, mentioned their support for eliminating the State Income Tax.

Judging from the success of past initiatives, candidates for office should embrace this issue to receive support from the majority of voters.

Building Grassroots Support

Coloradoans who are working for a Free State, need to keep Income Tax Elimination in their talking points.

With support from across the political spectrum, Colorado’s Income Tax can be Eliminated!

Encouraging candidates to embrace this issue will help ensure this issue remains at the top of the voter’s awareness.

The Income Tax in Colorado will be repealed, it’s just a matter of time.

Support for Income Tax must become an issue that prevents candidates from winning elections.

When this happens, Colorado will be one step closer to becoming a Free State.

Follow on Telegram: t.me/FreeStateColorado

Recent Comments