Ballots are dropping across Colorado.

Of course, you can still vote in person, but most Colorado voters will mail their ballot back or drop it off.

You have until Tuesday, November 7th by 7 PM to drop them off at your local county drop box.

This is an off-year election, so turnout is expected to be relatively low compared to a Presidential election year.

According to the Colorado Secretary of State website, active voter turnout in 2021 was only 40.17% compared to 86.54% in 2020 and 66.27% in 2022.

This means that 2.3 million active voters did not turn in a ballot in 2021!

This also means that your vote has a much bigger impact in 2023 than it does in other election years.

Let’s take a look at the two statewide ballot measures for the 2023 Colorado Election.

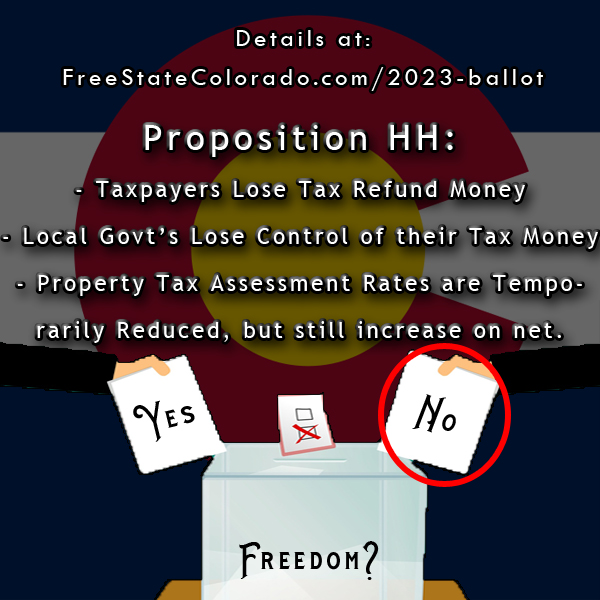

Proposition HH: Reduce Property Taxes & Retain State Revenue

This measure is on the ballot because it was referred to Colorado voters by the State Legislature and the Governor.

Colorado Legislators knew for years that property taxes were going to be increasing, but they waited until the very end of the legislative session to do anything about it.

SB23-303 was introduced in the last week of the Legislative Session and passed right before the session ended.

The short time frame led to outcry by community members and lawmakers, who didn’t have the proper time to read the bill, understand it, create amendments or discuss it.

House Republicans even walked out of the chamber to protest this bill being shoved on the legislature with no time for them to perform their proper roles:

After the Governor signed SB23-303, Prop HH was created for this year’s ballot.

Immediately, the Governor was hit with a lawsuit calling the bill and referred ballot measure unconstitutional.

However, the judge in the case said he doesn’t have jurisdiction, as explained in this article:

Judge David Goldberg on Friday ruled that he did not have jurisdiction to consider the case, citing, in part, a precedent that “requires that courts refrain from interfering with the ongoing legislative process except in extraordinary circumstances.”

If the ballot measure passes, there is an opportunity for it to be challenged in court.

Another important thing to understand is that Colorado’s Legislature could have lowered the assessment rates and changed how property taxes are calculated WITHOUT voter approval.

It is completely within the power of the Legislature to adjust property tax rates.

If you know politics, you are probably wondering why Authoritarian Democrats would put a tax decrease on the ballot. Well, it’s because it also raises taxes!

So why did they put Prop HH on the ballot?

Well, thanks to the Taxpayer Bill of Rights (TABOR), the Legislature does NOT have the power to raise taxes without asking voters for permission to do so.

In order to “retain state revenue” (aka keep tax money that was supposed to be refunded), the Legislature needs to ask the voters.

What does Prop HH do?

Proponents of the measure are claiming that Prop HH will provide property tax relief.

It’s true that property taxes would marginally decrease for property owners, but it’s also true that Prop HH would be a tax increase.

If passed, it would temporarily lower the residential assessment rate from 6.765% to 6.7% in 2023 until 2033.

This minor decrease in property taxes will barely be noticeable with the massive increase that property owners will see in 2024.

In 2033, the residential assessment rate would increase to 7.15%.

This complicated bill has more to it, which you can read on the Fiscal Note for SB23-303.

Additionally, Prop HH, if passed, would allow the State Government to keep some of our Taxpayer Bill of Rights guaranteed tax refund to reimburse local governments for their lowered property tax revenue.

Over $122 million in taxpayer money would be kept by the State for fiscal year 2022-2023 (current), over $167 million for fiscal year 2023-2024, over $358 million for fiscal year 2024-2025.

This means that Colorado taxpayers and the Colorado economy will lose big and the State will win.

Proposition HH allows the State to give our tax money to local governments, shifting control of tax money from your local community to the State.

This is one of the reasons why Colorado’s local government lobby groups are all opposed to Prop HH.

Colorado Counties Inc. (CCI), The Colorado Special Districts Association (SDA), and The Colorado Municipal League (CML) all oppose Prop HH.

Local governments are against it.

Pro-taxpayer groups are also against it.

If you want to see who is spending big money supporting Prop HH, watch my video with Natalie Menten: Where’s the Money Coming From? Exposing the Money Behind Proposition HH

Natalie and myself have also recorded a series of videos on Colorado Property taxes, why they have increased and real solutions. You can watch them here.

There is a lot more to talk about regarding Prop HH, but I hope you understand the big takeaway:

Colorado taxpayers will lose tax refund money if Prop HH passes, and property taxes will still increase.

This is bad for liberty.

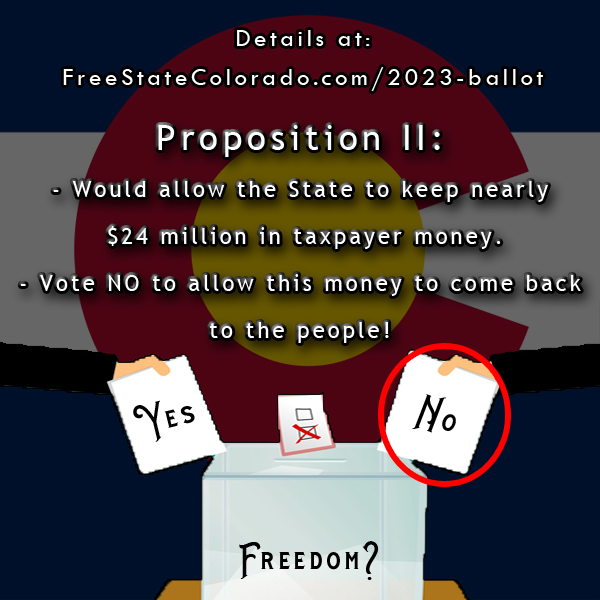

Proposition II: Retain Nictotine Tax Revenue in Excess of Blue Book Estimate

This measure is also on the ballot because it was referred to Colorado voters by the State Legislature and the Governor.

HB23-1290 was also passed by the Legislature in the last week of the Legislative Session.

The background is that Proposition EE was passed by the voters in 2020, which increased tobacco taxes and brought in over $200 million in revenue to the State’s General Fund.

Thanks to the Taxpayer Bill of Rights, Colorado taxpayers should be getting tax refunds totaling $23.65 million.

Proposition II, if passed, would allow the State to keep this money.

Because Prop II takes tax refund money away from Coloradans, it should be opposed by liberty-minded individuals.

Vote No to return nearly $24 million in tax money to the taxpayers.

Prop. II is bad for Liberty.

Well, that’s all we got this year for ballot measures.

If you want to see the candidates I’ve recently interviewed, check here: https://freestatecolorado.com/category/2023-election/

Recent Comments